Mongolia’s Reset: Political Transition, Fiscal Reform, and Continued Fudamental Momentum

A shift in leadership signals renewed fiscal discipline, deeper public accountability, and hopeful continuity for foreign investors.

I. Timeline of Key Events: May - June 2025

- May 28, 2025 - Public protests break out in Ulaanbaatar after reports emerge that Prime Minister Oyun-Erdene’s son is living abroad in apparent luxury. Online photos and videos circulate widely, sparking national debate about political privilege and accountability.

- June 4, 2025 - In response to mounting unrest, Prime Minister Oyun-Erdene Luvsannamsrai tenders his resignation. He frames his departure as a decision to preserve public trust and institutional integrity, while reaffirming Mongolia’s commitment to international investment partnerships.

- June 5 - 10, 2025 - Political negotiations ensue within Parliament. Several senior figures are considered for succession, including those with backgrounds in economics and finance.

- June 12, 2025 - Zandanshatar Gombojav is confirmed as Prime Minister by Parliament. A former central banker and Speaker of Parliament, Gombojav pledges to “restore public confidence through fiscal reform and transparency” while maintaining economic continuity.

- June 13, 2025 - The new Prime Minister unveils his first policy package, including $640 million in budget cuts, progressive tax restructuring, and a renewed push to finalize a preferential trade agreement with the Eurasian Economic Union (EAEU).

II. Context: A Reset, Not a Reversal

For observers and investors alike, Mongolia’s recent leadership change should be viewed not as political instability, but as a demonstration of the country’s maturing democratic responsiveness. Public frustration over inequality and perceived elite privilege found expression through peaceful protest, and the swift yet orderly transition of power underscores the institutional strength underpinning Mongolia’s economic trajectory.

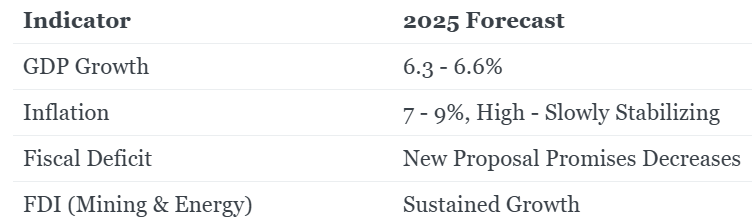

Importantly, the core macroeconomic agenda—driven by mining exports, infrastructure investment, and regional integration—remains unchanged. Mongolia continues to project 6.3 - 6.6% GDP growth in 2025, with foreign direct investment (FDI) steady in key sectors.

III. Gombojav’s Background: Technocratic Credibility

The newly appointed Prime Minister, Zandanshatar Gombojav, brings significant financial and institutional experience to the role:

- Served as Speaker of Parliament (2019 - 2024)

- Previously held senior roles at the Mongolian Development Bank

- Early career in central banking and fiscal oversight

- Educated in public administration with exposure to OECD regulatory frameworks

Seen as a moderate with technocratic leanings, Gombojav is well positioned to reassure international investors while pursuing targeted domestic reforms. His rise represents a shift toward greater fiscal discipline, institutional professionalism, and long-term planning.

IV. Policy Priorities: Fiscal Rebalancing and Trade Integration

1. Budget Reforms

Gombojav’s government announced $640 million in expenditure reductions for FY2025. This rollback focuses on reducing inefficient subsidies and reprioritizing spending toward rural services, infrastructure, and debt servicing. The objective is to preserve macroeconomic stability and address rising public debt concerns.

2. Tax Reform

A new progressive tax package is in development, with aims to:

- Reduce burdens on middle- and lower-income households

- Raise revenue from luxury goods, high-income earners, and speculative land holdings

- Expand the formal economy by simplifying small business compliance

3. Inflation & Food Security

With headline inflation at 9.1% as of March 2025, driven by energy imports and food costs, the new cabinet is pursuing:

- Investment in domestic renewable energy

- Strategic reserves and price buffers for key staples

- Acceleration of infrastructure for livestock and grain logistics

4. Regional Trade Strategy

The government has reaffirmed its commitment to finalize a trade agreement with the Eurasian Economic Union (EAEU). This deal will significantly reduce tariffs on grains, dairy, meat, machinery, and vehicles; providing supply-side relief and strengthening regional integration with Russia, Kazakhstan, Belarus, and Armenia.

V. Continuity in Foreign Investment: The Oyu Tolgoi Anchor

Former Prime Minister Oyun-Erdene leaves behind a crucial legacy: the stabilization of Mongolia’s relationship with Rio Tinto and the completion of Phase II development at the Oyu Tolgoi copper-gold mine.

In an interview published by The Australian just prior to his resignation, Oyun-Erdene stated:

“Oyu Tolgoi is the keystone of our national economic plan. The confidence of international partners must remain protected by our institutions—no matter the administration.”

While Prime Minister Zandanshatar Gombojav has expressed a hopeful outlook for Mongolia’s investment environment, he has not made explicit guarantees to uphold all existing foreign mining agreements. Government communications indicate that major projects like Oyu Tolgoi are continuing operations without immediate changes to licensing or tax structures, but recent developments, such as paused work on certain underground areas pending license transfers, underscore ongoing complexities. Gombojav brings extensive experience in regulatory and development frameworks, with a strong understanding of international development practices, which positions him to navigate Mongolia’s evolving economic landscape.

VI. Outlook: Democratic Maturity Meets Market Stability

International observers, including the World Bank and ADB, continue to view Mongolia favorably:

- ADB revised Mongolia’s growth outlook upward following strong Q1 export performance.

- The World Bank praised Mongolia’s medium-term fiscal framework, which targets:

- GDP growth of 6.5% by 2028

- Inflation reduction below 6%

- Prioritized spending on education, food supply chains, and logistics

VII. Investor Takeaways: Mongolia Can Enter a Disciplined Growth Phase

Mongolia’s political reset, while rapid, reflects accountable governance and long-term institutional capacity. Investors should note:

- No reversal in foreign investment posture

- Renewed fiscal discipline and tax clarity

- Strong momentum toward regional integration

- Strategic sectors—copper, gold, agriculture, and energy—remain government priorities

As global supply chains recalibrate and mineral demand increases, Mongolia is poised to offer both stability and upside. Gombojav’s administration represents a technocratic continuation rather than a populist break—marking this not as a moment of retreat, but of strategic recalibration.

Breaking Insights From Our Regional Partners

Our contacts at Ard Financial Group, a key regional financial institution, have provided an important update on Mongolia’s new government reforms, underscoring the administration’s ambitious agenda to drive fiscal discipline and sustainable growth.

- Interest Rate Cuts: Prime Minister Zandanshatar is coordinating closely with the Bank of Mongolia to lower interest rates, aiming to ease borrowing costs and stimulate private sector activity in a still-inflationary environment. This move signals a pragmatic approach to balancing inflation control with growth support.

- Budget Discipline: The government has committed to USD 643 million in spending cuts through a supplementary budget. This aligns with previously announced fiscal rebalancing goals and reflects a focus on efficiency by trimming non-essential expenditures while protecting critical services.

- Tax Reform: The administration is targeting a lower overall tax burden for most businesses and households, paired with increased taxes on luxury goods and imports. This progressive approach aims to widen the tax base and improve equity without dampening core economic activity.

- State-Owned Enterprise (SOE) Overhaul: A major structural reform involves halving the number of SOEs. This reduction seeks to enhance efficiency, reduce fiscal drag, and encourage private sector dynamism by curbing state monopolies.

- Private Sector Development: Beyond mining, the government plans to diversify the economy by improving the overall business climate. This includes reforms to regulatory frameworks, support for SMEs, and encouragement of new industries, essential for long-term resilience.

- Mega Projects: Continuity in focusing on 13 strategic mega projects demonstrates a steady commitment to infrastructure and extractive sector development, critical for sustaining Mongolia’s export-driven growth model.

- Foreign Investment & Digital Transformation: The government is reiterating its openness to foreign investors, coupled with initiatives to accelerate digital transformation across sectors. This dual focus aims to modernize the economy while maintaining Mongolia’s attractiveness to global capital.

- Ministerial Restructuring: The ongoing reshuffle of ministerial portfolios is expected to streamline government functions and ensure alignment with reform priorities, signaling institutional strengthening.

- Investor Messaging: This announcement sends a clear message to the market. Mongolia is embracing reforms, fiscal discipline, and growth-oriented policies. It marks the country as an “Oasis for Democracy” and a favorable destination “Open for Business,” as will be highlighted at the upcoming Mongolia Economic Forum on July 8th and 9th.

Let us know what you think of these breaking developments in the comments below.